If you’ve ever made a bank transfer or received one, you’ve likely encountered the term “UTR number.” But what exactly does a UTR number mean, and why is it important for tracking your financial transactions? In this comprehensive guide, we’ll break down everything you need to know about UTR numbers, including how to check and track them like a pro. Whether you’re a novice or a seasoned banker, understanding UTR numbers is essential for ensuring your money is moving smoothly and securely. Let’s dive in!

What Does UTR Number Mean?

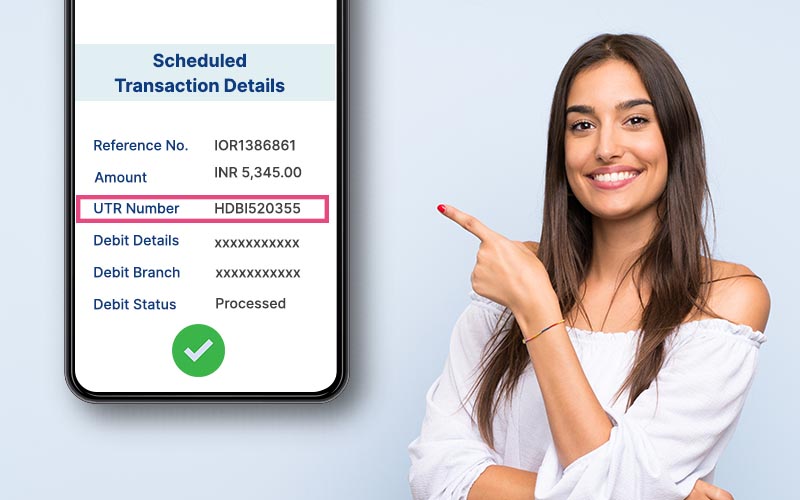

The term UTR number means “Unique Transaction Reference number.” It is a unique identifier assigned to each financial transaction processed by a bank. Think of it as a digital fingerprint for your transaction. Whenever you initiate a bank transfer—whether it’s a domestic or international transaction—your bank generates a UTR number to distinguish it from millions of other transactions.

Why Is the UTR Number Important?

The UTR number serves several critical purposes in the banking system:

- Tracking Transactions: The most crucial function of the UTR number is to facilitate UTR number tracking. If you need to confirm whether a payment has been completed, the UTR number is what you’ll use to track the status of that transaction.

- Resolving Disputes: In cases where there is a dispute—such as when a beneficiary claims not to have received funds—the UTR number allows the bank to trace the transaction and verify its status.

- Enhancing Security: With millions of transactions occurring daily, the UTR number helps prevent errors and fraudulent activities by providing a unique identifier for each transaction.

How Is a UTR Number Generated?

A UTR number is automatically generated by the bank’s system when a transaction is initiated. The structure of a UTR number can vary slightly depending on the country and bank, but it generally consists of a combination of numbers and letters that make it unique. For instance, in India, the UTR number for RTGS (Real-Time Gross Settlement) and NEFT (National Electronic Funds Transfer) transactions is a 22-character code.

Where Can You Find the UTR Number?

After you initiate a transaction, the UTR number is typically included in the transaction confirmation message or email sent by your bank. You can also find the UTR number in your bank statement or in the “Transaction History” section of your online banking portal.

How to Perform a UTR Number Check

Performing a UTR number check is essential if you want to confirm that a transaction has been successfully processed or if you’re resolving a dispute. Here’s how you can check the UTR number:

- Bank’s Online Portal or App:

- Log in to your bank’s online portal or mobile app.

- Navigate to the “Transaction History” or “Recent Transactions” section.

- Locate the transaction you want to check and find the associated UTR number.

- Customer Service:

- Contact your bank’s customer service department and provide them with details of the transaction (such as the date, amount, and beneficiary).

- The customer service representative can perform a UTR number check for you.

- Bank Branch:

- Visit your bank branch and speak to a representative.

- Provide them with the transaction details, and they can assist you in checking the UTR number.

How to Track a UTR Number Like a Pro

Once you have the UTR number, you can perform UTR number tracking to see the status of your transaction. Here’s how you can do it:

- Through Your Bank:

- The simplest way to track a UTR number is through your bank’s online portal or customer service.

- Enter the UTR number into the provided field on the bank’s tracking page, if available.

- The system will display the transaction’s current status—whether it’s pending, completed, or failed.

- Online UTR Tracking Tools:

- Some banks provide online tools specifically designed for UTR number tracking.

- Visit your bank’s official website and look for the “Track Your Transaction” feature.

- Input the UTR number, and the tool will provide real-time updates on the transaction status.

- Email or SMS Notifications:

- Many banks offer SMS or email alerts for transactions. You can set up these notifications to receive real-time updates whenever a transaction is initiated or completed.

- The notification usually includes the UTR number, transaction status, and other relevant details.

Common Issues with UTR Number Tracking and How to Resolve Them

While UTR number tracking is generally straightforward, you may encounter some issues. Here are common problems and how to resolve them:

- Invalid UTR Number:

- Double-check the UTR number to ensure you’ve entered it correctly. Any error in the sequence can lead to tracking failure.

- Delayed Transaction Status:

- Sometimes, it may take a while for a transaction to be updated in the system, especially if the transaction is pending due to bank processing times or public holidays. In such cases, wait for a few hours and try again.

- System Downtime:

- If your bank’s tracking system is down for maintenance, you won’t be able to track the UTR number. Contact customer service or try again later.

- Cross-Border Transactions:

- For international transactions, tracking may take longer due to different banking networks and intermediaries involved. Ensure you have the correct UTR number format for cross-border tracking.

Tips for Effective UTR Number Tracking

- Keep a Record: Always keep a record of the UTR numbers for your transactions. This will save you time and hassle when you need to perform a UTR number check or resolve any issues.

- Stay Updated with Bank Policies: Different banks may have different policies and tools for tracking UTR numbers. Stay informed about your bank’s procedures to ensure seamless tracking.

- Leverage Technology: Use your bank’s mobile app for quick and easy access to transaction history and tracking features. Many banks also provide instant alerts for transactions, which can help you stay on top of your finances.

Conclusion

Understanding what a UTR number means and mastering the art of UTR number tracking are vital skills for anyone involved in regular financial transactions. By knowing how to find, check, and track UTR numbers, you can keep better control of your finances, resolve disputes quickly, and ensure that your money is moving exactly where it needs to go. With this guide, you’re now equipped to handle UTR numbers like a pro, ensuring your transactions are always secure and transparent.