In the intricate landscape of modern financial systems, a pivotal yet often overlooked aspect involves the intermediaries who facilitate the exchange of critical details. This section delves into the mechanisms by which these entities impact the processes of evaluation and decision-making in the realm of monetary transactions. It explores the implications of such involvement on individual confidentiality and digital safety.

Understanding the Dynamics: These mediators, commonly known as information aggregators, play a significant part in the collection and dissemination of data that is crucial for financial institutions. Their activities directly influence the methodologies used to gauge the creditworthiness of individuals and determine the terms of financial assistance. This influence extends to shaping the policies and practices that govern the protection of sensitive data and the prevention of digital breaches.

Challenges and Considerations: As we navigate through the complexities of data management in finance, it becomes essential to scrutinize the ethical dimensions and the potential risks associated with the handling of personal details. The balance between utility and protection is a delicate one, requiring constant vigilance and adaptation to evolving threats and regulatory standards.

Understanding Data Brokers in Financial Scoring

This section delves into the intricate mechanisms by which third-party information intermediaries influence the assessment processes in the realm of finance. It explores how these entities collect, analyze, and distribute data that significantly impacts the evaluation of borrower eligibility.

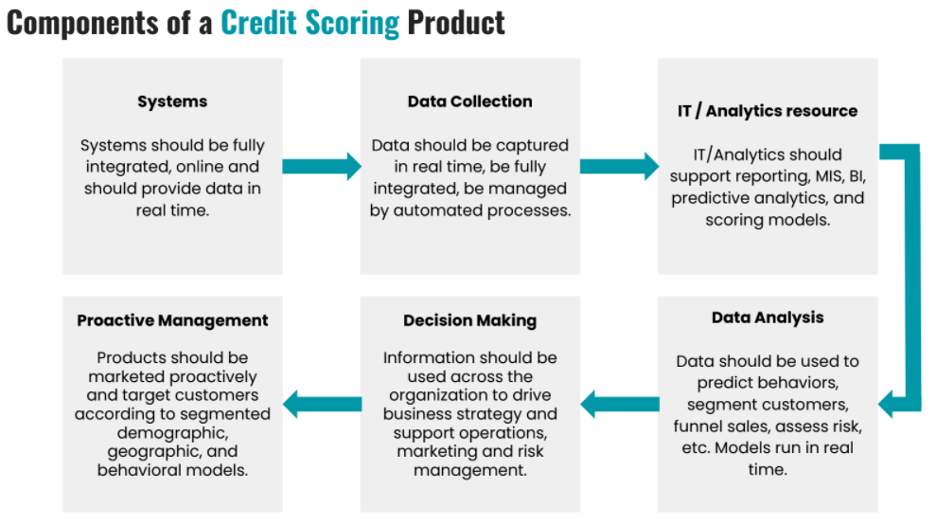

The activities of these intermediaries are pivotal in shaping the financial landscape. They gather vast amounts of transactional and behavioral data from various sources. This data is then processed and used to create profiles that help financial institutions gauge the creditworthiness of applicants. Here are some key aspects of how this process unfolds:

- **Data Collection**: Intermediaries compile information from public records, online activities, and other proprietary databases.

- **Data Analysis**: Sophisticated algorithms are employed to interpret the collected data, identifying patterns and trends that might not be apparent through manual review.

- **Data Distribution**: The analyzed data is sold to financial institutions, which use it to supplement their internal scoring systems, enhancing the accuracy of their assessments.

The impact of such data aggregation on credit decisions is profound. It allows for a more nuanced understanding of an individual’s financial behavior, which can lead to more tailored and potentially more equitable lending practices. However, this also raises significant concerns regarding the fairness and transparency of the process:

- **Fairness**: The reliance on third-party data can sometimes lead to biases, as not all data sources are equally reliable or free from discrimination.

- **Transparency**: The lack of clarity about what specific data is being used and how it is being interpreted can make it difficult for consumers to understand why certain credit decisions are made.

Understanding these dynamics is crucial for consumers, regulators, and financial institutions alike. It helps in navigating the complex interplay between data, technology, and financial decision-making, ensuring that the system remains robust, fair, and transparent.

The Impact of Data Aggregation on Credit Decisions

This section delves into the profound effects that the collection and consolidation of various types of records can have on the process of determining financial eligibility. The focus here is on how the aggregation of diverse data sets influences the outcomes of financial assessments, which are crucial for individuals seeking access to various financial products.

In the realm of financial evaluations, the amalgamation of numerous data points from different sources plays a pivotal role. This process, often referred to as data aggregation, involves the gathering of transactional, behavioral, and demographic details. These elements are then analyzed to create a comprehensive profile that financial institutions use to gauge an individual’s creditworthiness.

The implications of this practice are multifaceted. On one hand, it can enhance the accuracy and fairness of financial assessments by providing a broader view of an individual’s financial history and behavior. On the other hand, it raises significant concerns regarding the potential for misinterpretation of data, leading to biased or unfair outcomes. For instance, errors in data or the inclusion of irrelevant information can skew the evaluation process, adversely affecting an individual’s chances of obtaining financial assistance.

Moreover, the aggregation of data can lead to increased scrutiny of personal activities, which may not directly correlate with financial reliability. This can include aspects such as social media activity or shopping habits, which, when taken out of context, might be misconstrued as indicators of financial irresponsibility. Thus, the challenge lies in balancing the benefits of comprehensive data analysis with the need to protect individuals from unwarranted scrutiny and potential discrimination.

In conclusion, while data aggregation is a powerful tool in the financial assessment process, it is imperative to implement robust safeguards and clear guidelines to ensure that the use of such data is both fair and ethical. This involves continuous monitoring and updating of practices to reflect the evolving landscape of data collection and analysis, ensuring that the rights and interests of consumers are protected.

Privacy Concerns Arising from Data Broker Practices

This section delves into the apprehensions surrounding the handling of sensitive data by entities involved in financial assessments. It explores how the collection and dissemination of such information can lead to significant privacy issues, affecting individuals’ rights and security.

Data Aggregation Practices: The process of gathering vast amounts of user data by these entities often raises questions about the extent and methods of data collection. This can include anything from financial histories to behavioral patterns, all of which are crucial for making informed decisions in the financial sector.

Transparency and Consent: A major concern is the lack of transparency in how data is used and shared. Many users are unaware of the specific details their data is used for, and whether they have consented to such uses. This lack of clarity can lead to misuse or exploitation of personal details.

Data Protection Measures: Despite the growing awareness and regulations aimed at protecting user data, the effectiveness of these measures is often questioned. The complexity of modern data systems and the evolving nature of threats make it challenging to implement foolproof security protocols.

Legal Frameworks and Compliance: Various legal frameworks govern the operations of these data-handling entities. However, the interpretation and enforcement of these laws vary, leading to discrepancies in how data protection is practiced across different regions and organizations.

In conclusion, the handling of sensitive data in financial assessments is fraught with challenges related to privacy and security. Addressing these concerns requires a concerted effort from all stakeholders, including regulators, data handlers, and consumers, to ensure that data is used responsibly and securely.

Cybersecurity Measures in Protecting Personal Data

This section delves into the critical strategies employed to safeguard sensitive details from potential threats in the digital realm. Ensuring the integrity and confidentiality of user records is paramount in today’s interconnected world, where unauthorized access can lead to significant repercussions.

One of the primary methods for fortifying the defense of private records is through robust encryption protocols. These algorithms transform data into a format that can only be read by authorized parties, thereby thwarting attempts by malicious actors to interpret the information. Additionally, regular updates to security software are essential to combat emerging vulnerabilities that could be exploited by hackers.

Another pivotal strategy is the implementation of multi-factor authentication (MFA). This approach requires users to verify their identity through multiple means, such as a password and a unique code sent to their mobile device. By adding layers of verification, the likelihood of unauthorized access is significantly diminished.

Furthermore, it is crucial for organizations to conduct regular security audits. These assessments help identify weaknesses in the system and ensure that all security measures are functioning as intended. By proactively addressing potential issues, companies can better protect the sensitive information entrusted to them.

In the realm of regulatory compliance, adhering to established frameworks such as the General Data Protection Regulation (GDPR) is essential. These guidelines set forth stringent requirements for the handling and protection of personal data, and failure to comply can result in substantial penalties.

Lastly, educating users about safe online practices is a fundamental aspect of any comprehensive security strategy. By raising awareness about the risks associated with sharing personal information online and the importance of maintaining strong, unique passwords, individuals can play a significant role in safeguarding their own data.

In conclusion, the protection of sensitive records requires a multifaceted approach that combines advanced technological solutions with diligent oversight and user education. By implementing these measures, organizations can mitigate the risks associated with data breaches and uphold their responsibility to protect the information they handle.

Legislation and Regulations Governing Data Brokers

This section delves into the legal frameworks and regulatory measures that oversee the activities of entities involved in the collection and analysis of consumer data for financial assessments. It explores how these regulations aim to balance the need for accurate financial evaluations with the protection of individual rights and confidentiality.

In recent years, there has been a significant increase in the attention given to the legal oversight of these entities. Various jurisdictions have enacted laws and regulations to ensure transparency, fairness, and security in the handling of sensitive consumer data. Below is a table summarizing some key legislative and regulatory actions:

| Region | Legislation | Key Provisions |

|---|---|---|

| United States | Fair Credit Reporting Act (FCRA) | Ensures accuracy and privacy of information used in consumer reports, and provides consumers with rights to access and dispute information. |

| European Union | General Data Protection Regulation (GDPR) | Enhances privacy rights for EU citizens and imposes strict data protection requirements on entities handling personal data. |

| Canada | Personal Information Protection and Electronic Documents Act (PIPEDA) | Regulates the collection, use, and disclosure of personal information by private sector organizations. |

| Australia | Privacy Act 1988 | Sets out the rules for handling personal information, including obligations for entities to be transparent and accountable. |

These legislative and regulatory frameworks are crucial in defining the boundaries within which entities must operate. They not only protect consumer rights but also foster a more transparent and accountable environment in the financial sector. As the digital landscape evolves, ongoing updates and enhancements to these laws are essential to keep pace with technological advancements and changing consumer expectations.

Consumer Rights and Data Broker Transparency

In this section, we delve into the critical aspects of ensuring that individuals are aware of and can exercise their entitlements regarding the use of their details by third-party entities. The focus is on enhancing openness and accountability in the processes that involve the collection and analysis of consumer data.

Transparency is a cornerstone in the relationship between consumers and those who handle their sensitive details. It is imperative that these entities clearly communicate their methods of data acquisition, the purposes for which the data is used, and the measures taken to safeguard this information. This clarity not only fosters trust but also empowers consumers to make informed decisions about their personal data.

Consumer rights encompass the ability to access, correct, and sometimes delete the information held by these entities. It is essential that regulations are in place to enforce these rights, ensuring that consumers can challenge inaccuracies and control the extent to which their details are utilized.

Furthermore, the implementation of robust security protocols is vital to protect consumer data from unauthorized access and breaches. This includes encryption, secure data storage practices, and regular audits to ensure compliance with current security standards.

Legislation plays a pivotal role in defining and enforcing these rights and transparency requirements. It is crucial that laws keep pace with technological advancements and the evolving landscape of data handling, ensuring that consumer protections remain effective and relevant.

In conclusion, the interplay between consumer rights and the transparency of data handling practices is a complex but essential area of focus. Ensuring that consumers are fully aware of their entitlements and that data handlers are held accountable is key to maintaining a fair and secure environment for personal data management.

Future Trends in Data Brokerage and Lending

In this section, we delve into the evolving landscape of financial information management and decision-making processes. As technology advances and regulatory frameworks adapt, the strategies employed by intermediaries in the financial sector are poised for significant transformations.

Advancements in Algorithmic Decision-Making: The integration of sophisticated algorithms is set to redefine how financial assessments are conducted. These algorithms, powered by machine learning and artificial intelligence, promise to enhance the precision and speed of evaluation processes, thereby streamlining the allocation of funds.

Regulatory Compliance and Transparency: With growing emphasis on consumer rights and data protection, future practices will likely see a stronger alignment with regulatory requirements. This shift will necessitate greater transparency in operations, ensuring that consumers are well-informed about how their data is utilized and the implications of such usage.

Emerging Technologies in Data Protection: The realm of data security is continuously evolving, with new technologies such as blockchain and advanced encryption methods gaining traction. These innovations are expected to bolster the integrity and security of financial data, mitigating risks associated with unauthorized access and data breaches.

Shift Towards Ethical Data Handling: Ethical considerations are becoming increasingly prominent in the discourse surrounding financial data management. Future trends may witness a more pronounced focus on ethical data handling practices, ensuring that the use of consumer information aligns with societal norms and expectations.

Consumer Empowerment Through Data Access: Empowering consumers with greater control your online presence over their financial data is another anticipated trend. This could involve facilitating easier access to and management of personal financial records, enabling consumers to play a more active role in the decision-making processes that affect their financial well-being.

As we navigate these trends, it is crucial to balance innovation with consumer protection, ensuring that the advancements in financial data management serve the broader interests of society while respecting individual rights and privacy.