Market Overview 2032

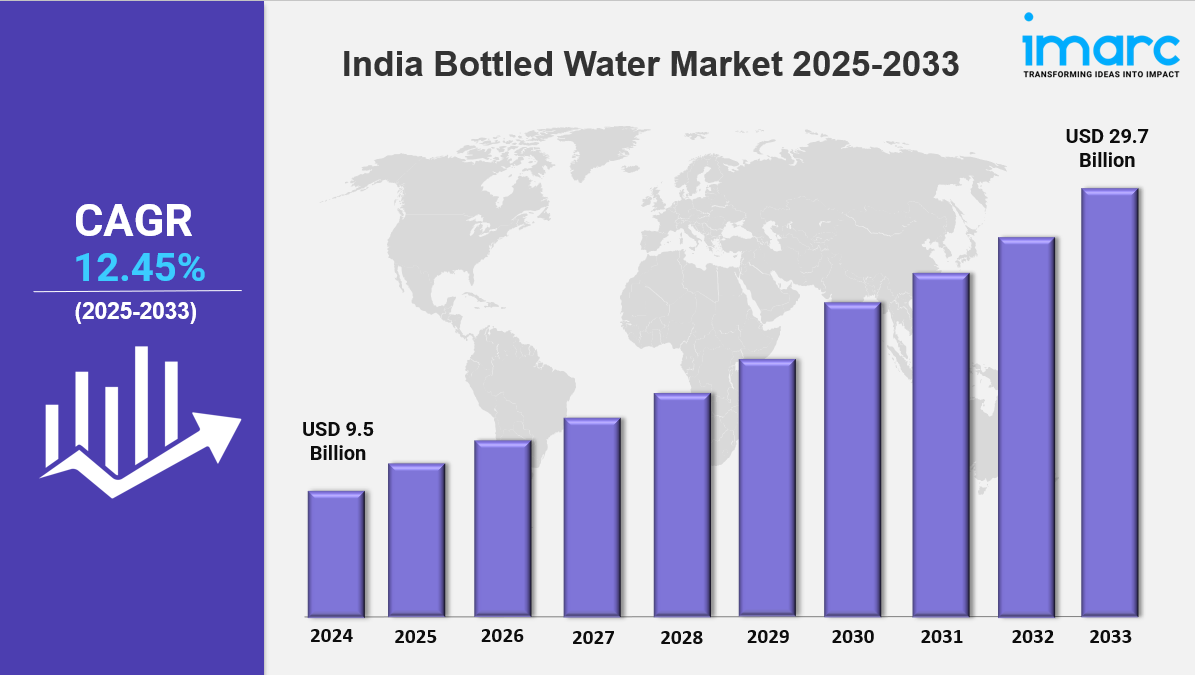

India bottled water market size reached USD 9.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 29.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.45% during 2025-2033. The market is witnessing steady growth, driven by increasing health awareness and demand for safe drinking water. Urbanization, changing consumer preferences, and rising concerns about water quality are boosting the sector’s expansion.

Key Market Highlights:

✔️ Strong market growth driven by increasing health awareness and urbanization

✔️ Rising demand for premium, flavored, and mineral-enriched bottled water

✔️ Expanding focus on eco-friendly packaging and sustainable water sourcing solutions

Request for a sample copy of the report: https://www.imarcgroup.com/india-bottled-water-market/requestsample

India Bottled Water Market Trends and Driver:

The Indian market for bottled water is changing significantly as more Indian consumers become health-conscious. People are switching from sugary drinks to bottled water as a healthier way to stay hydrated. This change is most noticeable in cities, where new drinking habits have been brought about by shifting lifestyles and increased disposable cash. These changing tastes have led to an increase in the demand for mineral and purified water, which is now thought to be necessary for leading a healthy lifestyle.

Customers’ growing awareness of the need of staying hydrated has also been aided by the extensive availability of health information online. In response, companies that sell bottled water have positioned their goods as essential for wellbeing and health, which has fueled the market’s explosive expansion in India. The market has also been driven by the focus on convenience in urban environments. Because bottled water is readily available at supermarkets, retail establishments, and online marketplaces, students and working professionals are choosing portable hydration options. Customers can now remain hydrated even more easily thanks to on-demand delivery services, which in turn pushes firms to use creative packaging and distribution techniques to adapt to the shifting demands of the market.

Environmental concerns are playing a growing role in shaping India bottled water market trends. As awareness of plastic waste and environmental issues rises, consumers are becoming more selective about their choices. This has led to a shift towards eco-friendly practices within the industry. Bottled water companies are increasingly using recyclable materials and focusing on sustainable sourcing. Many brands are also working to reduce their carbon footprint, gaining a competitive advantage by aligning with consumers’ environmental values. This shift reflects changing preferences and underscores the importance of corporate social responsibility in driving India bottled water market growth.

The premium bottled water segment is another key trend in India’s bottled water market. Consumers are seeking high-quality products that offer additional health benefits, such as alkaline or flavored mineral water. The rise of online shopping is also transforming the market, with e-commerce platforms becoming essential for distribution, particularly in 2024. As more consumers embrace the convenience of online shopping, direct-to-consumer models are thriving.

Sustainability remains a central focus as well, with brands adopting eco-friendly packaging solutions to address environmental concerns. As these trends continue to shape the market, the India bottled water market share is expected to expand significantly. Health-consciousness, convenience, and sustainability are the key drivers behind this sector’s dynamic growth trajectory.

India Bottled Water Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product Type:

- Still

- Carbonated

- Flavored

- Mineral

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145