The global electro-optical/infrared (EO/IR) systems market size, valued at USD 15.07 billion in 2025, is projected to grow at a compound annual growth rate (CAGR) of 3.7%, reaching USD 18.88 billion by 2033. EO/IR systems play a crucial role in a variety of applications, particularly in military, aerospace, and defense sectors, where the need for enhanced surveillance, target tracking, and imaging capabilities is paramount. These systems combine electro-optical and infrared technologies to provide clear and precise images in both daylight and low-light or no-light conditions, offering significant strategic advantages.

In this blog post, we will explore the key factors driving the growth of the EO/IR systems market, key trends shaping its future, the challenges faced by the industry, and the segments contributing to its overall expansion. Through a data-driven, insightful approach, we will provide a comprehensive overview of this dynamic market.

Key Market Drivers for EO/IR Systems

- Rising Demand for Advanced Surveillance Systems: The increasing need for high-resolution surveillance systems is one of the major factors driving the growth of the EO/IR systems market. With the growing emphasis on national security and defense, EO/IR systems are being deployed to monitor borders, coastal areas, and sensitive installations. These systems offer superior imaging capabilities in diverse environments, enabling continuous monitoring and enhancing security measures.

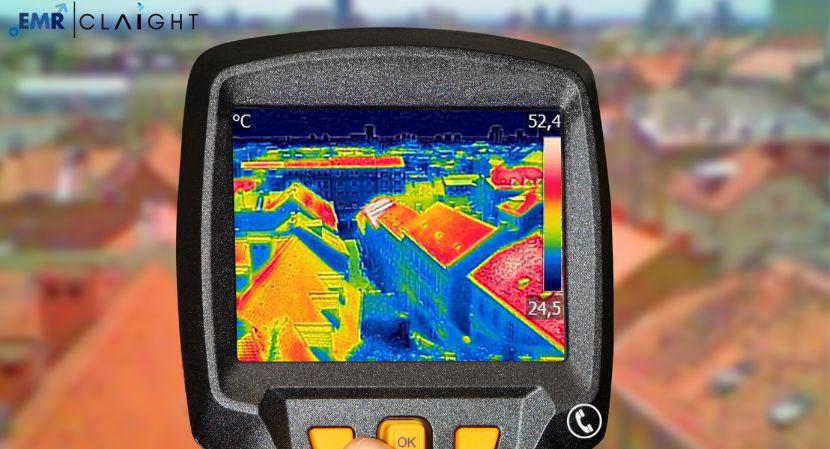

- Advancements in Sensor and Imaging Technologies: Technological advancements in sensor technologies, such as cooled and uncooled infrared sensors, and imaging technologies like high-definition thermal cameras, have contributed significantly to the growth of the EO/IR systems market. The ability to detect and track targets in difficult environmental conditions, such as low visibility or harsh weather, has improved significantly, increasing the demand for these systems in both military and commercial sectors.

- Military and Defense Applications: The military sector is one of the largest consumers of EO/IR systems due to their use in surveillance, reconnaissance, and target acquisition. The growing focus on enhancing situational awareness in modern warfare and the demand for unmanned aerial vehicles (UAVs) and drones are further pushing the need for EO/IR systems. These systems enable military forces to detect, identify, and track threats in real-time, making them indispensable in defense operations.

- Commercial Applications in Aerospace and Civilian Use: While military and defense sectors are the primary drivers of the EO/IR systems market, the aerospace and civilian sectors are also contributing to its growth. EO/IR systems are increasingly being used in commercial aviation for improved flight safety and in search and rescue operations. The ability to operate in both day and night conditions is making EO/IR systems more valuable in non-defense applications, further driving their adoption.

Emerging Trends in EO/IR Systems

- Miniaturization of EO/IR Systems: One of the key trends shaping the EO/IR systems market is the miniaturization of these technologies. The development of smaller, more compact EO/IR systems allows for easier integration into a variety of platforms, including drones, UAVs, and even handheld devices. As the demand for unmanned systems grows, miniaturized EO/IR systems are increasingly in demand, providing enhanced capabilities in a more versatile and portable form.

- Integration with Artificial Intelligence (AI): AI and machine learning technologies are being integrated with EO/IR systems to improve their efficiency and capabilities. The combination of AI with EO/IR technologies allows for the automated processing of images and data, enabling faster decision-making and real-time analysis. AI algorithms can help in target detection, pattern recognition, and even autonomous operations, further enhancing the functionality of EO/IR systems.

- Shift Towards Multi-Spectral and Hyperspectral Imaging: The demand for advanced imaging technologies, such as multi-spectral and hyperspectral imaging, is increasing. These technologies provide more detailed information across different wavelengths, enabling enhanced target identification and analysis. This shift is expected to drive the growth of EO/IR systems that can operate across a wider range of wavelengths, providing more comprehensive data for surveillance and reconnaissance missions.

- Increased Use of EO/IR Systems in Commercial Drones: The growing popularity of drones for a variety of commercial applications is contributing to the expansion of the EO/IR systems market. Drones equipped with EO/IR sensors are increasingly being used for environmental monitoring, agriculture, infrastructure inspections, and even in the oil and gas industry for pipeline monitoring. As drone technology continues to evolve, the demand for EO/IR systems is expected to increase, opening new opportunities in non-defense sectors.

Challenges in the EO/IR Systems Market

- High Costs of Development and Maintenance: One of the primary challenges facing the EO/IR systems market is the high cost associated with the development, production, and maintenance of these systems. The advanced technologies involved, such as high-performance infrared sensors and imaging systems, can be expensive to manufacture. Additionally, the cost of integrating EO/IR systems into various platforms, including military vehicles, UAVs, and aircraft, can further drive up costs, limiting their adoption in some markets.

- Environmental and Operational Limitations: EO/IR systems, while highly effective in many environments, do have limitations. For instance, infrared systems can be affected by weather conditions such as heavy rain, fog, or snow, which can impact their effectiveness. In addition, the performance of EO/IR systems may degrade in extremely hot or cold conditions. Manufacturers are working to address these limitations by improving the reliability and robustness of these systems in diverse environments.

- Regulatory and Standardization Challenges: The rapid evolution of EO/IR technologies presents challenges related to regulatory and standardization issues. Governments and organizations may have varying regulations regarding the use of EO/IR systems, especially when it comes to civilian applications. Ensuring interoperability and standardization across platforms and systems is essential to the future growth of the market.

Market Segmentation and Forecast

- By Technology: EO/IR systems can be classified based on their technology, which includes electro-optical systems and infrared systems. Infrared-based systems are expected to dominate the market during the forecast period due to their ability to operate in low-light conditions and provide thermal imaging capabilities. This makes them indispensable for military surveillance and search-and-rescue missions.

- By Sensor Technology: The sensor technology segment includes cooled and uncooled infrared sensors, with cooled sensors expected to hold a significant market share due to their higher performance in terms of sensitivity and detection range. Uncooled sensors, however, are gaining traction due to their lower cost and ease of maintenance.

- By Platform: EO/IR systems are deployed on various platforms, including land-based vehicles, naval vessels, aircraft, and unmanned aerial vehicles (UAVs). UAVs are expected to see the highest growth in the coming years due to the increasing use of drones in both military and commercial applications.

- By End-Use: The end-use segment includes military and defense, aerospace, commercial, and others. The military and defense sector holds the largest market share, but commercial applications in areas such as search and rescue, infrastructure inspections, and environmental monitoring are expected to grow significantly.

Key Players in the Market

Leading players in the global EO/IR systems market include Raytheon Technologies Corporation, Lockheed Martin Corporation, Thales Group, Northrop Grumman Corporation, BAE Systems PLC, and Rheinmetall AG. These companies are investing in R&D and forming strategic partnerships to strengthen their market positions.