India Household Cleaners Market Overview

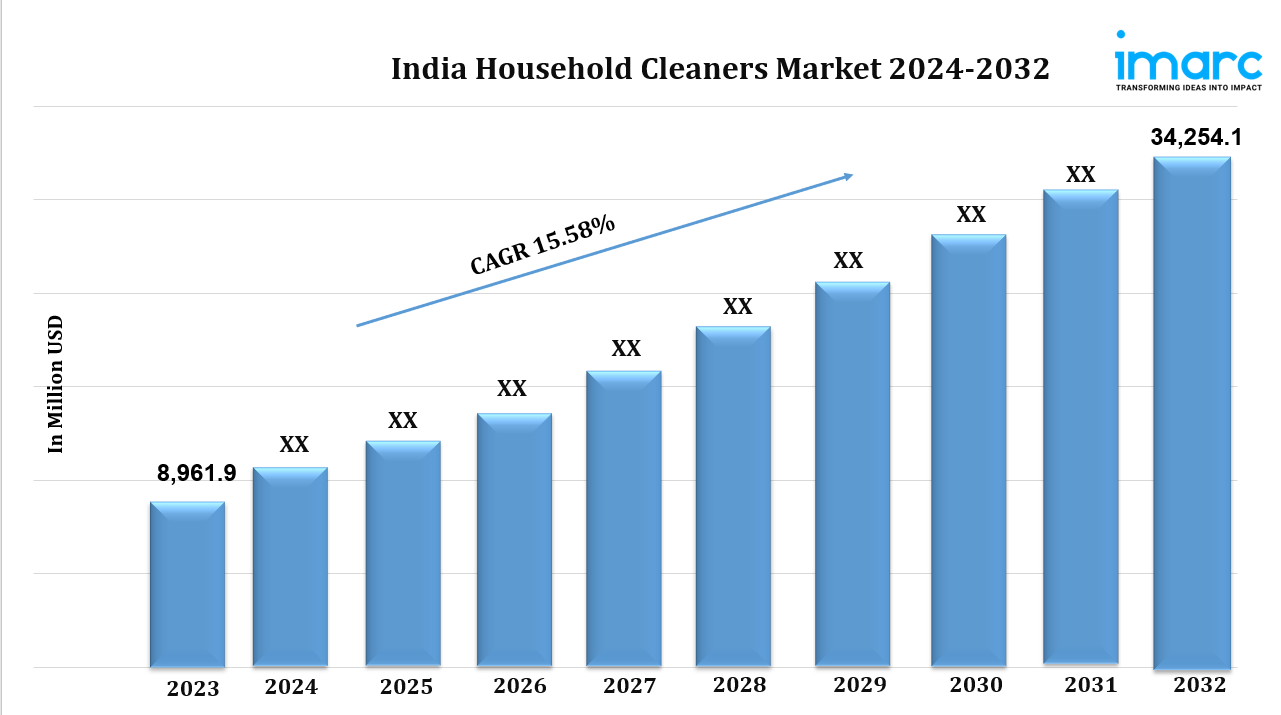

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 15.58% (2024-2032)

Market Size in 2023: USD 8,961.9 Million

Market Size in 2032: USD 34,254.1 Million

The India household cleaners market is rapidly growing, driven by urbanization, rising hygiene awareness, innovative products, and increasing disposable income. According to the latest report by IMARC Group, the market size reached USD 8,961.9 Million in 2023. Looking forward, IMARC Group expects the market to reach USD 34,254.1 Million by 2032, exhibiting a growth rate (CAGR) of 15.58% during 2024-2032.

India Household Cleaners Market Trends and Drivers:

In recent years, India’s household cleaners market has mirrored shifts in consumer preferences. Notably, there’s a rising demand for convenience. This has boosted the popularity of ready-to-use sprays and wipes. Consumers now seek easy solutions for cleaning, making it effortless to stay tidy. Concentrated cleaners are also on the rise.

They are cost-effective and cut down on packaging waste. Meanwhile, technology is making its mark in cleaning products. Brands are now exploring smart solutions. These include self-cleaning surfaces and app-connected devices. Personalization is another growing trend. Companies are offering tailored cleaning solutions to meet specific needs.

As we head into 2024, these trends are set to steer India’s household cleaners market. They will spark innovation and influence buying choices. The Indian household cleaners market is shifting towards eco-friendly products. Awareness of environmental issues and the dangers of chemical cleaners is driving this change. Consumers now seek greener alternatives. Brands are now making products with natural ingredients.

They use biodegradable packaging and sustainable practices. Urban consumers, more aware of sustainability, lead this trend. So, companies are investing in research for safe, effective cleaning solutions. These solutions aim to balance performance with environmental safety. As more consumers prioritize sustainability, the demand for eco-friendly products will grow.

This trend will make such products a key market segment. E-commerce is changing how cleaning products are sold in India. More people are using smartphones and the internet. This shift makes online shopping popular for its convenience and variety. Major e-commerce sites are now offering more cleaning products.

Younger shoppers, who prefer online shopping, drive this trend. They favor it over going to stores.Brands are also adopting digital marketing. They offer promotions and subscriptions to improve the online shopping experience. As e-commerce grows, it is changing how people buy and what they want in cleaning products.

The COVID-19 pandemic has made Indian consumers more aware of health and hygiene. This, in turn, has boosted the demand for cleaning products. People now seek effective solutions to eliminate germs and viruses at home. Sales of disinfectants, sanitizers, and multi-purpose cleaners have surged.

These products often claim to kill more germs. In response, manufacturers are innovating and reformulating their products. They highlight their effectiveness against common pathogens. As health and hygiene remain top priorities, growth in the cleaning market is expected to continue. This trend will shape product development and marketing strategies.

Download sample copy of the Report: https://www.imarcgroup.com/india-household-cleaners-market/requestsample

India Household Cleaners Market Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Product:

- Laundry

- Dishwashing

- Surface Cleaner

- Toilet Bowl Cleaner

- Window Cleaner

- Glass Cleaner

- Scourers

- Others

Breakup by Ingredients:

- Builders

- Solvents

- Surfactants

- Antimicrobials

- Others

Breakup by Distribution Channel:

- Convenience Stores

- Supermarkets and Hypermarkets

- Online

- Others

Breakup by Income Group:

- Middle (INR 2.5 lacs- INR 27.5 lacs)

- Low (Less than INR 2.5 Lacs)

- High (Greater than INR 27.5 lacs)

Breakup by Application:

- Fabric

- Kitchen

- Bathroom

- Floor

- Others

Breakup by Premiumization:

- Economy

- Mid-Sized

- Premium

Breakup by Region:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5001&flag=C

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145